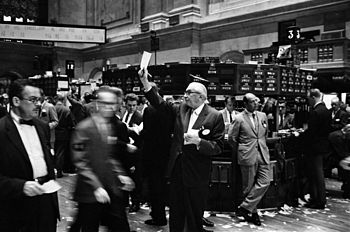

English: Photograph shows stock brokers working at the (Photo credit: Wikipedia)

Is It Really Possible To Make Money From Swing Trading?

Fast money stock-swing-trading really is possible and it is something that lots of people are doing. It is estimated, however, that 80% of those who try trading online wind up losing money and that 95% of those who try fastmoney stock-swing-trading lose their money as well. Successful swing trading involves a tremendous amount of practice and study as well as strict discipline and good money management skills. Most people simply aren't made for this task.

Identification

Swing trading requires people to identify stocks that are in a definitive trend and to then make a few short-term trades according to this trend by entering and exiting in order to gain maximum profits. Swing traders work with price moves that generally run around five days or more. They make purchases on price pullbacks and then ride them out until the next upwards swing when they try to sell these stocks as close to the very top of the wave as they can get. Unlike long-term trading, fastmoney stock-swing-trading does not require people to concern themselves with the fundamentals of companies such as their quarterly earnings as they are only focused on the stock chart instead.

Warning

For a lot of people, trend trading and other longer term systems that entail purchasing stocks in definitive trends and then holding onto these for a few months or even years, will usually prove more profitable than fast money stock-swing-trading. The techniques are rarely what cause problems for short-term traders, rather psychological issues and problems with money management are often their downfall.

Significance

Those who wish to try fast money stock-swing-trading should only work with money that they are able to lose. Traders who are anxious tend to make poor decisions, especially when they need to make successful trades in order to cover living costs or important bills and this almost always results in monetary loss. Traders like these become far too invested in their own wishful thinking and cannot manage to stay afloat after taking even small losses, thus, they tend to stay in bad trades and continue losing cash. They engage in compulsive trading when they should really be sitting out, such as when the market is extremely volatile or moving sideways.

Impacts

Those who must be right at all times will likely fail with swing trading. Swing traders have to be able to deal with a number of small losses even as they experience larger gains. With every trade, they have to decide upon a specific amount of money to risk and then cut their losses after this amount has been reached. Neither frustration nor hope should distract them.

Common Misconception

Fast money stock-swing-trading is too good to be true for those who think that this is an easy and quick way to amass wealth. Many advertisements are promoting systems that can generate up to $10k each morning, after which traders can go relax on the beach for the remainder of the day. Traders will have to have exorbitant sums of money to invest if they are to achieve these results and these ads are not selling magic systems, because these systems do not exist.

Things To Consider

Traders on the hunt for a Holy Grail system are incapable of succeeding in their efforts. Techniques for swing trading are easy to demonstrate and very straightforward and there are no secret formulas. A lot of people are able to learn about swing trading by reading reputable books and other publications and by visiting the websites of seasoned traders, then they practice trading on paper only, until they experience consistent success and are ready to make real trades. Swing traders have to have excellent money management skills, good risk analysis, plenty of patience and be psychologically disciplined. For people who possess these qualities, swing trading can produce significant profits and is definitely not too good to be real.