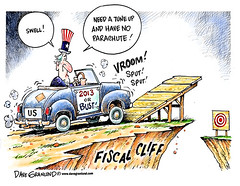

(fear) the Fiscal Cliff... (Photo credit: MyEyeSees)

There is heavy debate about the fiscal cliff and how it will affect the nation's long term debt; and how fiscal policy will effect growth over the next months and years. The outcome of the fiscal cliff negotiations are directly related to the functionality of the current political leadership and the status of the economy in 2012. These two areas are very much connected since the fiscal policy in both the US and Europe has already caused a drag on economic growth. The slowdown is expected to be ongoing as policymakers work on addressing the long term debt burdens.

For 2012, it seems that growth will be average. The first nine months of 2012 have shown growth of 2% and experts suggest that GDP in 2013 will grow about 2%. They also estimate that 2014 will show growth of 2.7% and 2015 at 2.9%. Unfortunately, these levels are still under 3%, which is considered to be healthy growth.

Fiscal tightening is expected to hamper the growth of 2013 earnings in the first half. The growth rate and the effect of the government drag on the economy are both dependent on whether a deal is met to avoid the fiscal cliff. On Wednesday, economists from Goldman shared that if no resolution is met to avoid the fiscal cliff, or if the fiscal tightening is larger than everyone assumes, then there could be a new recession looming.

Jan Hatzius, Chief Economist at Goldman, on Wednesday, stated that the public should not misinterpret what they are saying and that government budget consolidation is necessary over the medium term to capture those long term obligations that do require consolidation. The economist further shared that consolidation can have some negative effects on the economic growth and that adjustments should paced and not overdone. Hatzius further stated that once the world can get through the early part of 2013, even if there is tighter fiscal contraction, then growth should increase in the second half of 2013.